Mortgage interest rates have been climbing like a Space X rocket over the last month. I’ve been getting questions from potential sellers and buyers of homes in Smith Mountain Lake if the real estate market will be adversely affected by the recent increases.

It’s tough to say because 4% mortgage interest rates are still very low when you consider that in the 1980s and early 1990s, rates were in the mid to high teens. I spoke with a friend last night who said their first mortgage was 14%, and they felt like that was a good deal at the time!

Let’s look at what’s possible when mortgage interest rates go up as they have.

Some Buyers Won’t Be Able to Buy

Some buyers are on a bubble in every market with what they can afford to buy. One spike in the interest rates, and they are priced out of the market. It happens in every real estate cycle, no matter the interest rates.

Combine interest rates with the ascension in home values, and some can no longer afford it. The offers they are submitting, some buyers up to 20 to 30 over time, aren’t competitive in todays market.

The Effect of Fewer Buyers in The Housing Market

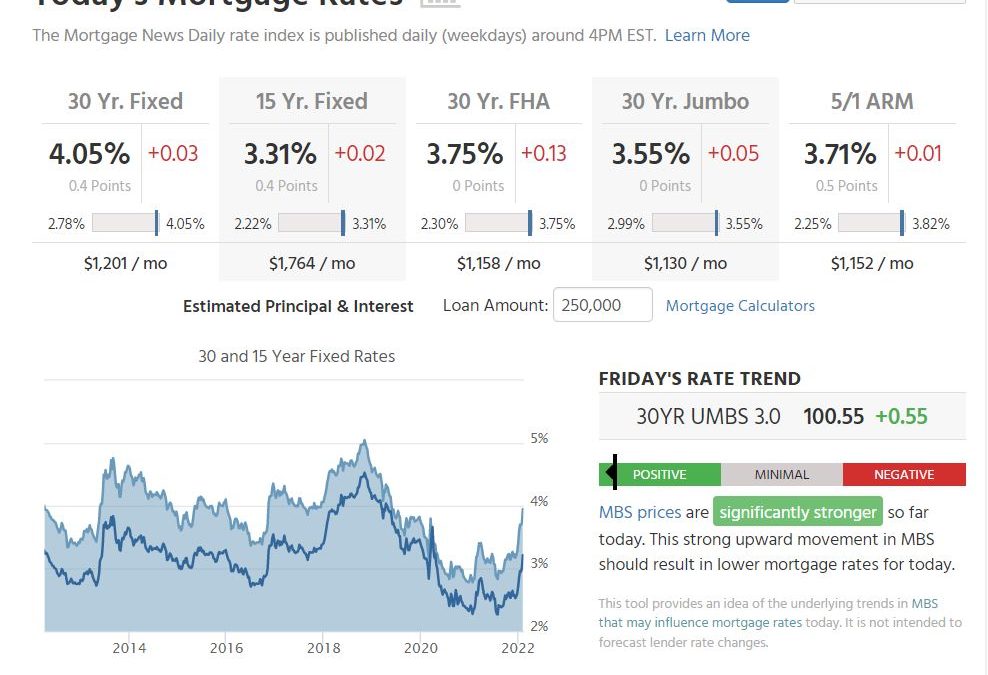

In the short term, buyers priced out of the current real estate market may not have much of an effect at all. As I said above, 4% is not a high-interest rate, and we’ve seen mortgage interest rates at 4% as recent as May 2019.

But as rates rise further, it could price even more buyers out of the market. Rising rates will curtail, on whatever level, demand. When demand slows, the number of homes for sale will slowly increase.

What Mortgage Interest Rates Will Do in 2022

A week or so ago, I was studying the prognostications on what interest rates would do in 2022. As a real estate professional, it’s part of the weekly, monthly research to stay current on local and national trends.

Most economists predicted that mortgage interest rates would finish the year around slightly under 4%. Surprise! Here we are now at 4%. While I’m sure there will be some revisions in the prognostications, the reality of it is that no one knows what interest rates will do to finish out the year.

What we know is what is happening now. I have a client that locked in a 3% loan just last week before the federal jobs report came out, which was expected to be negative and turned out to be better than expected. They avoided an increased mortgage rate by not pushing their luck and locking in at 3%.

My advice is if you’re interested in buying a Smith Mountain Lake home, get it done sooner than later. As mortgage rates climb, it gets more expensive to purchase. We know where we are now, but we don’t know where rates will end the year. The difference in affordability could be dramatic.

If you need help buying a home, don’t hesitate to contact me. I’ve got over 40 years of selling real estate in Smith Mountain Lake and can help you find the perfect home for you! Please click here for my contact page.

Thanks for visiting!